Note: the tax agency/vendor for both of these items will be the Washington Department of Revenue, since in Washington State the DOR collects all of the sales tax and then distributes it to the local governments. In this case, you probably want to have two sales tax items, one for Seattle with a rate of 9.5%, and one for Snoqualmie with a rate of 8.6%. To illustrate this with an example, let’s say that you sell your products in Seattle, which currently levies a local sales tax rate of 3%, and in Snoqualmie, which currently levies a local sales tax rate of 2.1%. Local governments can levy additional sales tax of up to 3%.) (As of this writing, Washington State sales tax is 6.5%.

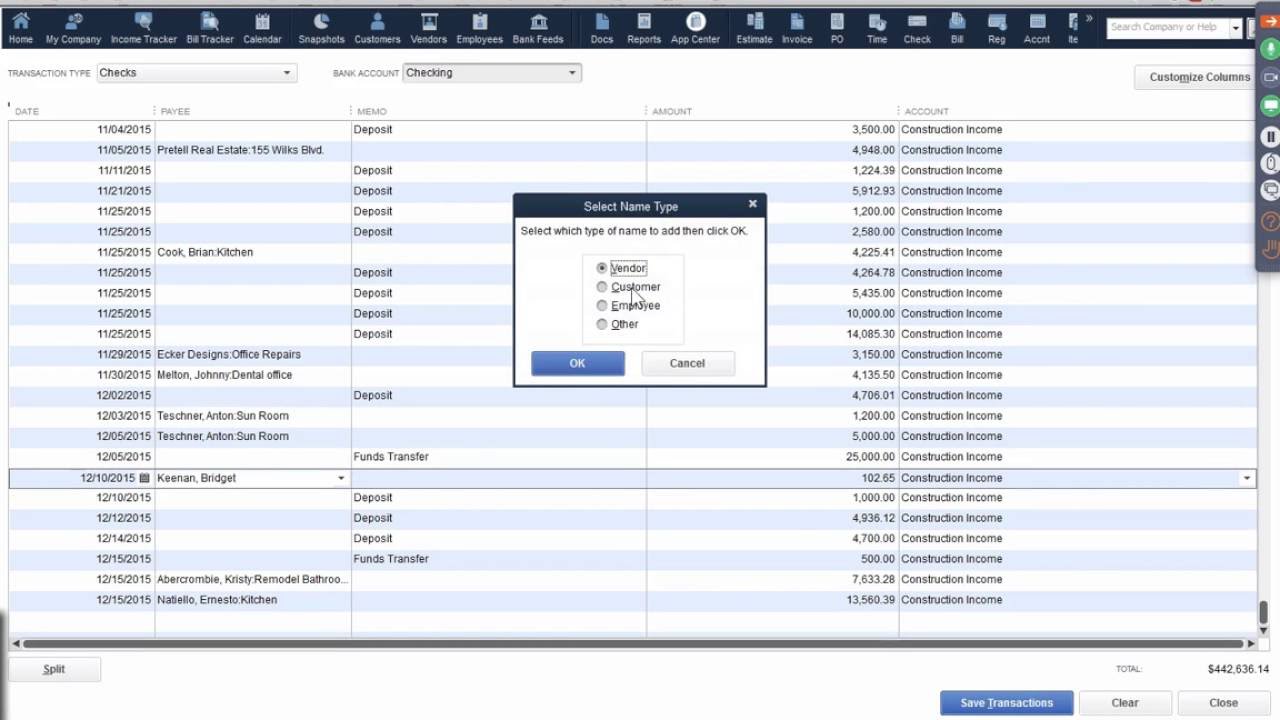

Intuit also has its own instructions here.īecause we operate in Washington State, let me provide two tips specific to Washington State.įirst, for a business in Washington State, you’ll probably want to set up a different sales tax item for each municipality where you do business. (The page says it provides instructions for QuickBooks 2012, but the instructions really work for any recent version of QuickBooks). Step-by-step instructions for creating a sales tax item are here. Specifically, you need take three steps: Step 1: Set up sales tax items in QuickBooks And you need to be confident that you can defend yourself in a sales tax audit.įortunately, QuickBooks makes calculating sales tax pretty easy if you take some time in the beginning to set things up right.

You should make sure you remit the right amount to the state government. You need to show the right sales tax amount on customer or client invoices, of course.

If you’re running a small business that sells items subject to sales tax, you want to do good accounting for sales tax.

0 kommentar(er)

0 kommentar(er)